80% of Marketplace

Fraud Starts in Chat.

Your Current Tools Are Blind.

ConvoGuard's AI-powered API detects fraud in marketplace conversations before the transaction happens. Integrate in 2 weeks. Prevent millions in losses.

Peter Orban

Founder of BLCKS

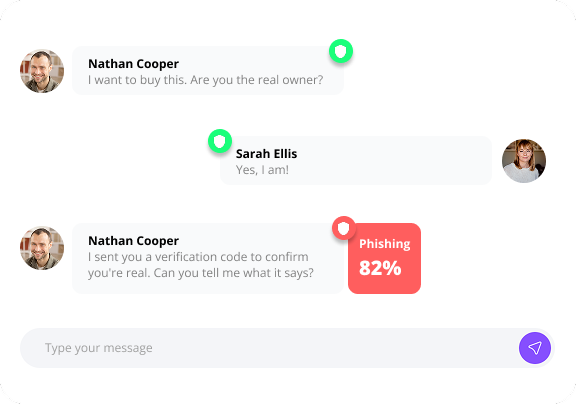

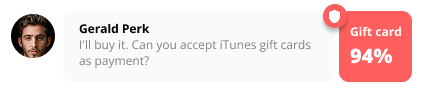

We detect fraud where it starts:

in the conversation.

Our 7-layer ML & AI engine analyzes every message in real-time, detecting social engineering tactics before the scam succeeds.

Why ConvoGuard beats

in-house solutions

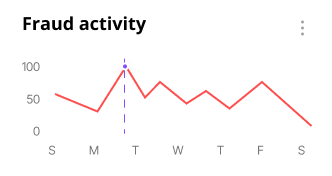

Stay ahead of scammers. Forever.

Scammers evolve their tactics every week, using new social engineering techniques and payment schemes to bypass your defenses. ConvoGuard continuously searches for and digitizes emerging fraud patterns that haven’t even reached your platform yet. Every time a new scheme is identified anywhere in our network or in the public and deep web, all ConvoGuard customers are automatically protected within 24 hours.

Preemptive detection

Continuously updated

Cross-Platform Fraud Intelligence

Every marketplace using ConvoGuard makes our AI smarter for everyone. When a scammer tries a new tactic on a Marketplace, we detect it and protect all our other customers automatically. This shared intelligence network is impossible to replicate with an in-house solution-your team would only learn from fraud on your own platform, always one step behind the scammers who operate across dozens of marketplaces.

Collective defense network

Super-Fast Integration

ConvoGuard is an API-first solution designed for developer happiness. Send us a message via our REST API, and we return a risk score (0-100) and a recommended action (allow, warn, block, or flag for review) in milliseconds. No complex SDKs, no UI components to integrate, no infrastructure to manage.

API-First Integration

No SDKs. No Overhead.

Multi-step validation based on risk score

Our 7-layer ML and AI engine analyzes every conversation in real time, detecting subtle social engineering tactics before a scam can succeed. ConvoGuard identifies fraud events both instantly and in batch, enabling adaptive, multi-tiered response strategies that match the severity and context of each threat. This multi-step validation not only reduces operational costs but also ensures every fraud case is handled with the most effective detection approach.

Cost-Efficient Precision Defense

Designed for platforms that move money

From online marketplaces to neobanks, our solutions are designed to protect your users and your business. work.

Online Marketplaces

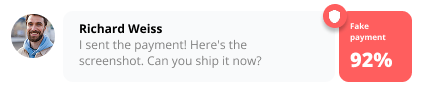

Most fraud starts in chat where scammers build trust and push users off-platform to Zelle, WhatsApp, or fake payment pages. ConvoGuard closes this gap by monitoring messages in real time to catch social engineering, off-platform payment solicitation, and fake payment schemes-reducing losses while protecting user trust.

Banks & Neobanks

Scammers exploit internal chat and mobile banking messaging to impersonate staff and trigger wire transfers before fraud systems flag them. ConvoGuard analyzes every conversation in real time to stop phishing, social engineering, and account takeovers-protecting customer funds and your reputation.

Common

Questions

Clear Answers

Find quick, concise answers to the most common questions about ConvoGuard.

ConvoGuard was founded by former banking executives, fintech technologists, and NLP experts.

Together, we combine decades of financial experience with advanced AI research to detect and prevent emerging fraud patterns before they cause damage.

Let's meet

Fraud is evolving. Are you ready?

Sign up for free and experience AI-driven fraud protection that detects emerging scams across platforms — stop threats before they spread.